How To Fill United Overseas Bank Ltd Cheque

United Overseas Bank Ltd

It is conducted with the aim of informing all the public in ASEAN about their banking information. United Overseas Bank was established in 1935. United Overseas Bank is also known as UOB. United Overseas Bank is a banking company headquartered in Singapore.

They open an account very quickly without keeping the customer in the bank. There is no charge, but the bank gives interest once every three months for the money kept in the bank account. They provide pass book debit cards for the customer to use this account.

United Overseas Bank Ltd Cheque

Banks also provide a cheque book from the bank for your convenience. This cheque book is very easy to withdraw money from one’s account and transfer money from one account to another account. There is no charge for the cheque received upon opening. After that a fee of up to $20 is charged at peak times. Using a cheque is very easy. You can ask the bank manager how to use the cheque. It will be very useful for you.

A cheque should be used with care. Because there are chances of the cheque getting bounced due to some reasons. A fee of up to USD 40 is paid from the bank on such return. So, before giving a cheque to the bank, we have to cheque whether all the information asked in the cheque is correct and whether there are any mistakes and then give it to the bank manager for processing.

Also it is better to give processing after verifying whether there is money in the checking account. Because there are opportunities for that too as a cheque write. A cheque should not be wrapped. Because there are chances of cheque return while processing. A cheque should be processed so that it is not returned.

How to Fill a cheque

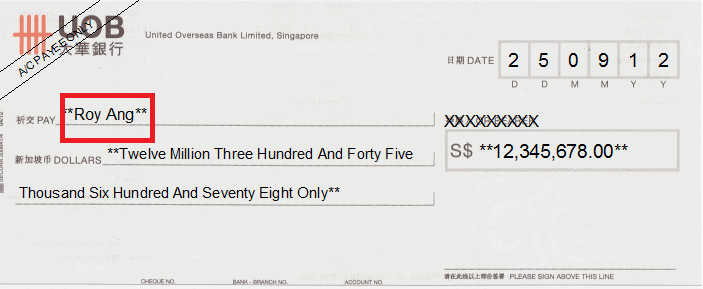

Step: 1

Date is very important for processing a cheque. The date should be written as 25-09-2012 as Day Month Year.

Step: 2

If a cheque is to be given to another person, their name should be written as “Roy Ang’ in the “Pay” field and processed. If you are using pay then you should write self

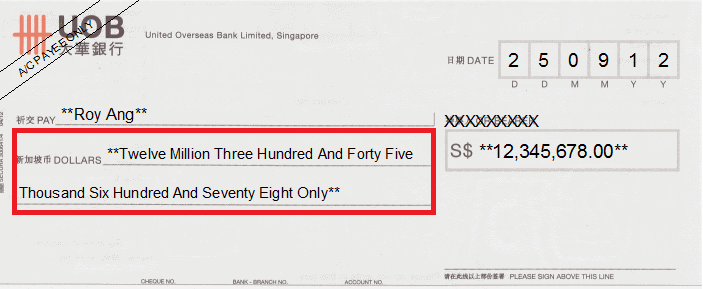

Step: 3

The amount should be written as twelve million three hundred and forty five thousand six hundred and seventy eight only in words.

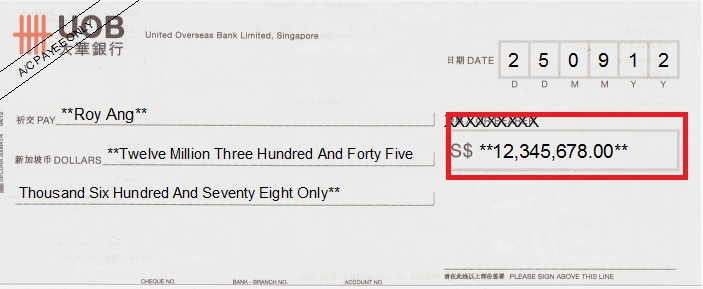

Step: 4

The amount should be written as 12,345,678 in number form.

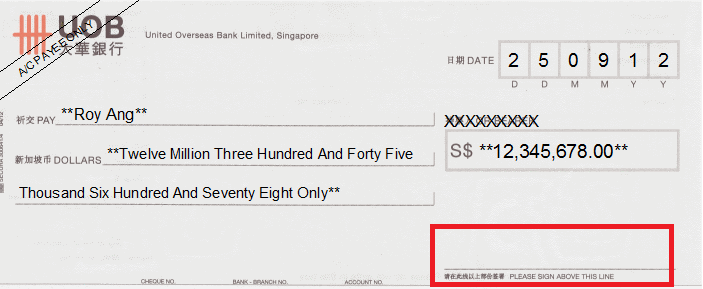

Step: 5

You should sign the cheque in the same way as you signed when the account was opened. It is better to write your signature and your mobile number on the reverse side of the cheque. Because the bank manager can contact you in a very simple way to get any information. This makes the cheque process faster.

All of this information will help you fill out the cheque. This information will definitely be useful for you.