LIC Jeevan Tarun Scheme

LIC is the only thing that comes to mind for all of us when it comes to insurance. But now they are setting up insurance in many ways. But LIC is a public sector company. This LIC is very old company. But this lic company brings more savings plan than many private companies. The plan that we are going to see in this way is the Jeevan Tarun plan of LIC.

LIC Jeevan Tarun Scheme is designed with future protection and savings in mind for children. LIC Jeevan Tarun Scheme is designed to meet the educational needs of children. Your savings start small as this program starts from a young age. Do you think you can do something for children? This plan will surely be a useful saving for education and their marriage or to meet any of their needs.

LIC jeevan tarun scheme Details for this project can be found here

This scheme is a saving for children. For that you can avail this scheme from the birth of a child from three months onwards. Similarly children can avail this scheme only till their age is below 12 years. This scheme will maintain the savings of the scheme till the age of 20 years of a child only. No matter what age the children are, the payment will be made only till the age of 20 years. The money will be withdrawn when the children turn 25years.

Step: 1

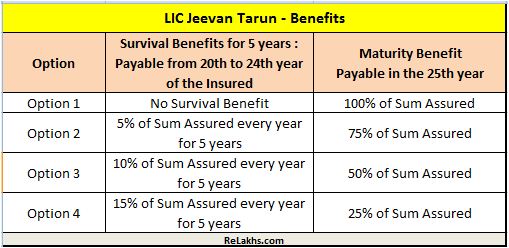

Sometimes you cannot withdraw any money while paying the premium. You get up to 100% cashback after the premium is over.

Step: 2

After the child turns 20, you can withdraw up to five percent from your savings plan. By doing so you can get savings of up to 75% on this plan.

Step: 3

After 20 years, you can withdraw up to 10 percent from that savings and you can get up to 50 percent of the result of this scheme in cash as you withdraw money and use it.

Step: 4

After paying the premium you can withdraw up to 15% after the child reaches 20 years of age. Your premiums end up being up to 25 percent because you use the money that way.

LIC jeevan tarun scheme Benefits of the scheme

This scheme is not related to any stock market. So it is a safe saving scheme. There is no tax explanation in this plan and there is no tax on the money you pay and your final payout. This LIC scheme has also set up a mechanism for you to take a loan in case of any emergency.

Payment methods offered by LIC Jeevan

If you see in this LIC he asks for his savings month by month and pays in three monthly installments, six monthly installments or yearly installments. They can set it up as per their convenience. You can use this premium amount for any emergency from your paid money. If you see what it can be used for, it can only be used for medical expenses and study expenses. That too can withdraw only up to 5% 10% 15%.

If you are availing loan through this scheme you must have paid the premium of this scheme continuously for at least three years. You can get loan through this scheme only if you have paid accordingly.

LIC Jeevan Tarun Premium Extension

For example, when you activate the scheme when a child is 12 years old, you can pay the premium of this scheme only up to the age of the child. Maturity money of the scheme will also be withdrawn at the age of 25 years of the child.

When you pay a premium for a 12-year-old child, the premium is only for eight years. This savings amount can be set as per your wish. For a child savings plan you need to save 150 rupees every day. 54,000 per annum premium will be paid while taking such.

If you pay Rs 54,000 per year, the premium will be Rs 4,32,000 for 8 years. For this 4 lakh 32 thousand rupees paid by you as surety money at the age of 25 years of the child in LIC jeevan tarun scheme bonus minimum maturity money loyalty all these together you will get up to 8,40,000 in your hand. You will almost double your hard earned money.

LIC jeevan tarun scheme special feature

If you don’t like the plan after joining the plan, you can get your money back within 15 days. If the premium you pay is sometimes late, you can get stuck with the premium that you fail to claim within the next month. This premium payment facility can be paid online or through a LIC agent or directly at the LIC office.

Joining this program is very helpful for your children to make their life dreams come true. This LIC plan is also a good saving for you so join this plan and avail yourself this information will definitely be very helpful for you.